gulyasmir.site

Community

Credit Cards Provide Rental Car Insurance

Credit card car rental coverage requires putting the entire rental cost on the card providing coverage. · Credit card rental car coverage commonly covers the. Best Credit Cards for Car Rental Insurance for August · Chase Sapphire Preferred® Card: Best for primary car rental coverage · The Platinum Card® from. Provides reimbursement for damage due to collision or theft for most rental vehicles when traveling within the U.S. and abroad. Top 3 Cards for Car Rental Insurance ; Chase Ink Business Preferred ; Chase Ink Business Premier ; Chase Sapphire Preferred. Your Visa rental car insurance will cover any damage or loss and towing charges resulting from an accident or theft as well as any loss of use fees charged by. This Description of Coverage replaces any and all Descriptions of Coverage previously issued to the insured with respect to insurance described herein. Go. Car Rental Loss and Damage Insurance · Delta Skymiles® Reserve for Business Credit Card. View Policy (opens new window) · Business Green Rewards Card. View Policy. Many of the largest credit card companies offer rental car collision coverage as an added perk. But what exactly does their plan cover? Chase Sapphire Reserve provides rental car coverage up to $75, and does not exclude expensive/exotic vehicles. Both cards have additional limitations. Credit card car rental coverage requires putting the entire rental cost on the card providing coverage. · Credit card rental car coverage commonly covers the. Best Credit Cards for Car Rental Insurance for August · Chase Sapphire Preferred® Card: Best for primary car rental coverage · The Platinum Card® from. Provides reimbursement for damage due to collision or theft for most rental vehicles when traveling within the U.S. and abroad. Top 3 Cards for Car Rental Insurance ; Chase Ink Business Preferred ; Chase Ink Business Premier ; Chase Sapphire Preferred. Your Visa rental car insurance will cover any damage or loss and towing charges resulting from an accident or theft as well as any loss of use fees charged by. This Description of Coverage replaces any and all Descriptions of Coverage previously issued to the insured with respect to insurance described herein. Go. Car Rental Loss and Damage Insurance · Delta Skymiles® Reserve for Business Credit Card. View Policy (opens new window) · Business Green Rewards Card. View Policy. Many of the largest credit card companies offer rental car collision coverage as an added perk. But what exactly does their plan cover? Chase Sapphire Reserve provides rental car coverage up to $75, and does not exclude expensive/exotic vehicles. Both cards have additional limitations.

Your eligibility is determined by your financial institution. Visa® Commercial Card. Travel and Emergency Assistance Services. Emergencies can escalate quickly. Most credit cards will cover damage from an accident or theft of the rental car. It's secondary to your auto insurance and will pay expenses that policy doesn'. In the United States, the coverage provided by this benefit is secondary. This means that if You have another insurance policy that will cover the cost of. If You are renting outside of Your country of residence, the coverage provided when renting a Rental Vehicle from a rental car agency, which describes in full. When you use your Visa card to book a car and pay the full price of the rental, you are covered by this insurance. · To access this coverage you must decline the. Many credit cards offer some type of insurance for rental cars. This benefit can be helpful if an unfortunate accident or theft happens to your rental. Credit card rental car insurance only covers costs associated with repairing or replacing the rental car itself. That means it doesn't cover: Personal liability. Best Issuer: Chase is the best credit card company for rental car insurance, covering cardholders for up to $75K and 31 days. No Rental Coverage: Synchrony Bank. Certain Bank of America credit cards offer rental car insurance coverage. This includes the Bank of America Travel Rewards credit card, the Alaska Airlines Visa. - Copy of the declarations page of any primary vehicle insurance and other valid insurance or coverage. If you have a rental car, be sure to call the rental. If you already have auto insurance coverage for collision damage, liability, personal property, theft and other areas, you probably can decline additional. Credit Card Coverage Explained: · No Liability Insurance: It's a common misconception, but credit cards generally do not offer liability insurance, which is a. Credit card rental car insurance plans may not cover loss of use,4 but Allianz Global Assistance's rental car insurance does. The coverage may be basic. Most credit cards offer some form of rental car coverage if things go awry, but not all coverage is created equal. Here are our favorite cards with rental. All four major credit card companies provide some form of rental car insurance. · MasterCard is the only company of the four that doesn't provide coverage on all. In short, credit card rental car insurance covers the car, not you. To protect against those risks, you can either purchase those specific coverages from the. That's because Turo is not a rental car company. We're a peer-to-peer car sharing platform, so credit card companies may provide no coverage for a car booked. Auto Rental Collision Damage Waiver reimburses You for damages caused by theft or collision -- up to the Actual Cash Value of most rented cars. No, not all credit cards provide car rental insurance benefits. However, many credit cards offer this protection to some extent, whether as a primary or. The coverage provided by these cards is typically an auto rental collision damage waiver, which helps cover damage due to collision or theft of the rental.

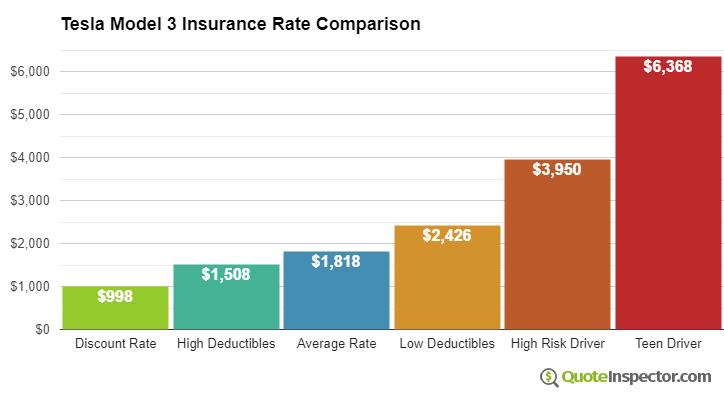

Is Insurance High For Tesla

Car insurance can be costly, especially when purchasing a luxury vehicle, such as a Tesla. Owing to the high value, repair costs, and claims costs of Tesla. Factors affecting rates for car insurance for Teslas · Vehicle specifications: The make, model, and production year of your Tesla may impact insurance premiums. Tesla Insurance offers competitively priced insurance products and tools that can help you drive safer. Read our step-by-step guides to get started. The average cost of car insurance for a Tesla model is about $4, per year. This is $1, worse than other luxury brands. Our car insurance comparison. Insurance guy here, the reason they are so expensive to insure is because of the high cost to repair, the lack of Aftermarket parts and the. The average price to insure a Tesla is about $2, a year according to some surveys. However, that number can vary significantly based on where you live, your. You may be able to get a cheaper car insurance rate for your Tesla by shopping around for auto insurance. Progressive auto insurance customers earn an average. Compare the cost of insuring a Tesla vehicle, with rates starting at $87 per month. Higher Insurance Costs: Generally, insuring a Tesla Model S or X will cost you more than an average vehicle. Why? Well, Teslas are high-tech. Car insurance can be costly, especially when purchasing a luxury vehicle, such as a Tesla. Owing to the high value, repair costs, and claims costs of Tesla. Factors affecting rates for car insurance for Teslas · Vehicle specifications: The make, model, and production year of your Tesla may impact insurance premiums. Tesla Insurance offers competitively priced insurance products and tools that can help you drive safer. Read our step-by-step guides to get started. The average cost of car insurance for a Tesla model is about $4, per year. This is $1, worse than other luxury brands. Our car insurance comparison. Insurance guy here, the reason they are so expensive to insure is because of the high cost to repair, the lack of Aftermarket parts and the. The average price to insure a Tesla is about $2, a year according to some surveys. However, that number can vary significantly based on where you live, your. You may be able to get a cheaper car insurance rate for your Tesla by shopping around for auto insurance. Progressive auto insurance customers earn an average. Compare the cost of insuring a Tesla vehicle, with rates starting at $87 per month. Higher Insurance Costs: Generally, insuring a Tesla Model S or X will cost you more than an average vehicle. Why? Well, Teslas are high-tech.

Tesla car insurance premiums are higher than the average rate. They also typically cost more to insure compared to other electric vehicles. These vehicles have. Tesla Model S insurance costs range from $ to $ per month. Depending on your model year and coverage, Allied is the cheapest company. A Tesla is generally a car with a higher (daily) value than the average car. For new Tesla's the most extensive coverage, the all-risk car insurance, is chosen. Particularly, one of the main reasons insurance for Tesla cars is so expensive is the high cost to repair the vehicle after a collision. To combat this, Tesla. Higher Insurance Premiums for Some Models: Teslas and other EVs can be more expensive to insure than traditional gasoline cars. This is partly. Your premium is based on a mile-weighted average of the daily Safety Scores over the last 30 days. The higher your Safety Score, the lower your premium will be. In general, insurance for electric vehicles may cost more due to the higher cost to repair or replace them. With Tesla being a premium electric vehicle. Tesla Insurance offers full coverage options with various limits and deductibles that can be tailored to your needs. How much it costs to insure a Tesla Model 3 depends on the type of car insurance you choose. The average cost of a full-coverage insurance policy for a Tesla. So, yes, Tesla insurance is more expensive, but it's worth it. where-to-get-car-insurance-tesla Insurance Rates for Tesla Cars. Electric car insurance rates. The average annual cost of Tesla car insurance comes in just above $3, ($ per month). However, insuring a Tesla doesn't necessarily have to be an. Electric vehicles, on average, have higher rates in general; they have a higher value, are expensive to repair, and have higher claim costs. But, as you know. Insuring a Tesla works the same way it does for any other vehicle, but these electric vehicles are expensive to insure. According to the National Association of. The average cost of car insurance for a Tesla model is about $4, per year. This is $1, worse than other luxury brands. Our car insurance comparison. Carrying limits above the value of your Tesla will cost you less than going cheap. – The insurance cost per thousand is lowered at the higher end of coverage. Tesla Model 3 drivers pay an average of $ more than the national average for full coverage insurance. However, the Model 3 is the cheapest Tesla model, and. These models appeal to tech fans, as well as company car drivers looking for low benefit-in-kind tax, who want the comfort of Tesla's Supercharger Network. But. Tesla Insurance says it charges less than the average insurer because it trusts its cars' advanced safety features. Plus, it has access to a wealth of data to. Car insurance on a Tesla can cost more than $ per month for full coverage, which is significantly more than the cost of similar coverage for other vehicles. Insurance costs for the Tesla Model 3 are about 20% higher than the average annual premium for all Tesla models insured with Youi.

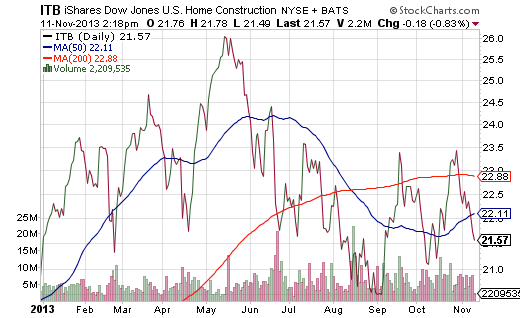

Ishares Us Home Construction Etf

ITB tracks a market-cap-weighted index of companies involved in the production and sale of materials used in home construction. The listed name for ITB is. What is ITB? The iShares Dow Jones U.S. Home Construction Index Fund seeks investment results that correspond generally to the price and yield performance. The Fund seeks to track the investment results of the Dow Jones US Select Home Construction Index composed of US equities in the home construction sector. The. In depth view into ITB (iShares US Home Construction ETF) including performance, dividend history, holdings and portfolio stats. iShares U.S. Home Construction ETF, Blackrock, $B, %, %, Equity: U.S. Housing. XHB, SPDR S&P Homebuilders ETF, State Street Global Advisors, $B. An easy way to get iShares U.S. Home Construction ETF real-time prices. View live ITB stock fund chart, financials, and market news. ITB Portfolio - Learn more about the iShares US Home Construction ETF investment portfolio including asset allocation, stock style, stock holdings and more. Get comprehensive information about iShares U.S. Home Construction ETF (USD) (US) - quotes, charts, historical data, and more for informed. ETF Summary. The index measures the performance of the home construction sector of the U.S. equity market, as defined by the index provider. ITB tracks a market-cap-weighted index of companies involved in the production and sale of materials used in home construction. The listed name for ITB is. What is ITB? The iShares Dow Jones U.S. Home Construction Index Fund seeks investment results that correspond generally to the price and yield performance. The Fund seeks to track the investment results of the Dow Jones US Select Home Construction Index composed of US equities in the home construction sector. The. In depth view into ITB (iShares US Home Construction ETF) including performance, dividend history, holdings and portfolio stats. iShares U.S. Home Construction ETF, Blackrock, $B, %, %, Equity: U.S. Housing. XHB, SPDR S&P Homebuilders ETF, State Street Global Advisors, $B. An easy way to get iShares U.S. Home Construction ETF real-time prices. View live ITB stock fund chart, financials, and market news. ITB Portfolio - Learn more about the iShares US Home Construction ETF investment portfolio including asset allocation, stock style, stock holdings and more. Get comprehensive information about iShares U.S. Home Construction ETF (USD) (US) - quotes, charts, historical data, and more for informed. ETF Summary. The index measures the performance of the home construction sector of the U.S. equity market, as defined by the index provider.

Complete iShares U.S. Home Construction ETF funds overview by Barron's. View the ITB funds market news. Get iShares U.S. Home Construction ETF (ITB:CBOE) real-time stock quotes, news, price and financial information from CNBC. iShares U.S. Home Construction ETF, Equity, Materials, $3,, %, 2,,, $, %, %, %, %, %, %, Building &. The best funds are the iShares U.S. Home Construction ETF, Invesco Dynamic Building & Construction ETF, and SPDR S&P Homebuilders ETF. The investment seeks to track the investment results of the Dow Jones U.S. Select Home Construction Index composed of U.S. equities in the home construction. Research iShares U.S. Home Construction ETF (ITB). Get 20 year performance charts for ITB. See expense ratio, holdings, dividends, price history & more. ITB - iShares U.S. Home Construction ETF - Stock screener for investors and traders, financial visualizations. In addition to pure play homebuilders, this fund includes companies related generally to the homebuilding industry, such as Home Depot. For homebuilder exposure. In trading on Thursday, the iShares U.S. Home Construction ETF (ITB) is outperforming other ETFs, up about % on the day. Components of that ETF. ETF information about iShares U.S. Home Construction ETF, symbol ITB, and other ETFs, from ETF Channel. ITB tracks a market-cap-weighted index of companies involved in the production and sale of materials used in home construction. ITB provides investors with a. The investment seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Dow Jones U.S. Select Home. Assess the ITB stock price quote today as well as the premarket and after hours trading prices. What Is the iShares US Home Construction Ticker Symbol? ITB is. View the latest iShares U.S. Home Construction ETF (ITB) stock price and news, and other vital information for better exchange traded fund investing. iShares U.S. Home Construction ETF, Equity, Materials, $3,, %, 2,,, $, %, %, %, %, %, %, Building &. iShares U.S. Home Construction ETF is an exchange-traded fund located in the USA. The Fund seeks investment results that correspond generally to the price. iShares US Home Construction ETF (ITB) is a passively managed Sector Equity Consumer Cyclical exchange-traded fund (ETF). iShares launched the ETF in The. Find the latest press releases from iShares U.S. Home Construction ETF (ITB) at gulyasmir.site The iShares U.S. Home Construction ETF (ITB) seeks to track the investment results of an index composed of U.S. equities in the home construction sector. WHY. About iShares U.S. Home Construction ETF (ITB). Sector: Financial. Industry: Exchange-Traded Funds. Headquarters: USA.

Top Stock Scanners

The Day Trade Dash scanners have been configured by successful traders, for traders, to provide the most high quality alerts possible. Trading works best when. A free stock screener from MarketWatch. Filter stocks by price Advertisement. Back to Top. Copyright © MarketWatch, Inc. All rights reserved. List of the Best Stock Scanners · Trade Ideas · FinViz · ThinkorSwim · TrendSpider · BlackBox Stocks · Benzinga Pro · Stock Rover. What Does a Stock Scanner Do? List of stock screeners · 1. TradingView · 2. BarChart · 3. Wallmine · 4. Finviz · 5. gulyasmir.site · 6. MarketInOut · 7. gulyasmir.site. Technical stock screener - find profitable trade setups based on technical analysis and stock chart patterns. Swing trade stock screener to filter the stock. Stock Screener · Exchange · Market Cap · Analyst Rating · Sector · Region · Country · Filtered by · See also. Yahoo Finance Screeners lets you choose from hundreds of data filters to discover Stocks, Mutual Funds, ETFs and more. StockRover. StockRover is the perfect free stock screener for day traders who like to use complex analytics to identify potential trades. StockRover's extensive. you can use stock scanners to filter stocks by industry, price, the average number of shares that change hands during a day and more. The Day Trade Dash scanners have been configured by successful traders, for traders, to provide the most high quality alerts possible. Trading works best when. A free stock screener from MarketWatch. Filter stocks by price Advertisement. Back to Top. Copyright © MarketWatch, Inc. All rights reserved. List of the Best Stock Scanners · Trade Ideas · FinViz · ThinkorSwim · TrendSpider · BlackBox Stocks · Benzinga Pro · Stock Rover. What Does a Stock Scanner Do? List of stock screeners · 1. TradingView · 2. BarChart · 3. Wallmine · 4. Finviz · 5. gulyasmir.site · 6. MarketInOut · 7. gulyasmir.site. Technical stock screener - find profitable trade setups based on technical analysis and stock chart patterns. Swing trade stock screener to filter the stock. Stock Screener · Exchange · Market Cap · Analyst Rating · Sector · Region · Country · Filtered by · See also. Yahoo Finance Screeners lets you choose from hundreds of data filters to discover Stocks, Mutual Funds, ETFs and more. StockRover. StockRover is the perfect free stock screener for day traders who like to use complex analytics to identify potential trades. StockRover's extensive. you can use stock scanners to filter stocks by industry, price, the average number of shares that change hands during a day and more.

Create your own stock screener with over different screening criteria from Yahoo Finance Top ETFs · Top Mutual Funds · Options: Highest Open Interest. Discover the best stocks to buy with TIKR's innovative platform. Our powerful stock screener can help you find hidden gems & top investment opportunities. This guide explores the top stock scanners for day trading, their key features, settings, and practical applications. The daily range is calculated by taking the difference between the stock's daily high and daily low. If you are measuring this data over a period of time, you. Stock screener for investors and traders, financial visualizations. Use the comparison tool below to compare the top Stock Screeners on the market. You can filter results by user reviews, pricing, features, platform, region. top best stocks · 1. Infosys, , , , , , , , , , , · 2. ITC, , , Stock Scanners: Use Moneycontrol's Stock Scanners to discover promising stocks and access comprehensive market Top News; Buzzing Stocks. tset. Happy Vinayaka. Use gulyasmir.site's Stock Screener to search and filter stocks easily by multiple filters such as stock price, market cap, dividend yield and more. Use the Stock Screener to scan and filter stocks based on market cap, dividend yield, volume and analyst ratings and estimates. Create your own screener for. While dozens of stock screeners already exist, WallStreetZen's free stock screener is designed specifically for long-term, fundamentals driven investors who. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their. Stock Screener app for android is free and searches the US stock market based on technical analysis and stock chart patterns for stock trading. Zacks Stock Screener is a best in class tool for helping you find the right stocks for your investment strategy. Screen over U.S and international stocks using 50+ performance, fundamental and technical criteria. Over 30 years of price data and 10 years of. Within Stock Screener, you can learn how to filtrate ideal stocks that give you the best possibility to invest everyday. We are dedicated to help you learn. Some of the best free screeners on the web include those offered by Yahoo! Finance, StockFetcher, ChartMill, Zacks, Stock Rover, and Finviz. They all offer. Free stock screener for investors and traders. Use customizable AInvest screener to find stocks and winning strategies to fit your trading style. There is a huge variety of stock screening products available, and they often cater to different types of users. That can make direct comparison difficult. The Stocks Screener allows you to search for equities using custom filters that you apply. For the U.S. market, the Stock Screener uses pre-market prices.

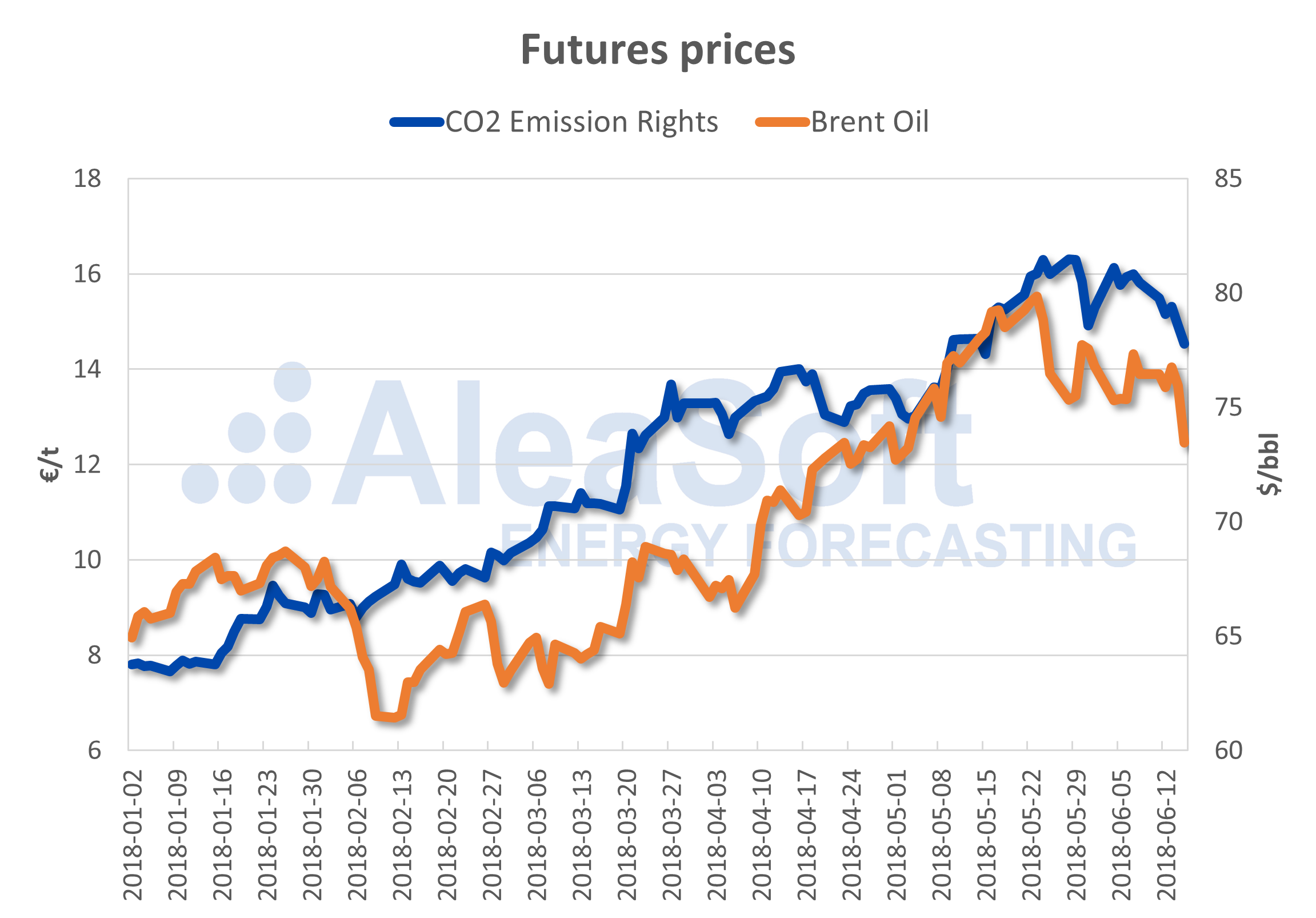

What Is The Price Of Co2

Weighted average global direct carbon price The global weighted-average direct carbon price was about $23/tCO2e in ; however, the IPCC estimates that an. bp supports a price on carbon because it's fair, efficient and effective. A well-designed carbon price provides the right incentives to decarbonize the entire. Carbon pricing (or CO 2 pricing) is a method for governments to mitigate climate change, in which a monetary cost is applied to greenhouse gas emissions in. The SPC is based on estimates of the lifetime damage costs associated with greenhouse gas emissions, known as the social cost of carbon (SCC). The following. Carbon pricing is an instrument that captures the external costs of greenhouse gas (GHG) emissions—the costs of emissions that the public pays for. The carbon tax was introduced in at a rate corresponding to SEK (EUR 25) per tonne fossil carbon dioxide emitted, and has gradually been increased to. Latest models of the social cost of carbon calculate a damage of more than $ per ton of CO 2 as a result of economy feedbacks and falling global GDP growth. A multi-year study of the social cost of carbon, a critical input for climate policy analysis, finds that every additional ton of carbon dioxide emitted into. The price is applied at a rate of $X per ton (in $) of CO2 emitted through combustion, rising at Y percent above inflation. The price is initially imposed. Weighted average global direct carbon price The global weighted-average direct carbon price was about $23/tCO2e in ; however, the IPCC estimates that an. bp supports a price on carbon because it's fair, efficient and effective. A well-designed carbon price provides the right incentives to decarbonize the entire. Carbon pricing (or CO 2 pricing) is a method for governments to mitigate climate change, in which a monetary cost is applied to greenhouse gas emissions in. The SPC is based on estimates of the lifetime damage costs associated with greenhouse gas emissions, known as the social cost of carbon (SCC). The following. Carbon pricing is an instrument that captures the external costs of greenhouse gas (GHG) emissions—the costs of emissions that the public pays for. The carbon tax was introduced in at a rate corresponding to SEK (EUR 25) per tonne fossil carbon dioxide emitted, and has gradually been increased to. Latest models of the social cost of carbon calculate a damage of more than $ per ton of CO 2 as a result of economy feedbacks and falling global GDP growth. A multi-year study of the social cost of carbon, a critical input for climate policy analysis, finds that every additional ton of carbon dioxide emitted into. The price is applied at a rate of $X per ton (in $) of CO2 emitted through combustion, rising at Y percent above inflation. The price is initially imposed.

Cost per tonne of carbon dioxide produced (€).

What is Carbon Pricing? Carbon pricing curbs greenhouse gas emissions by placing a fee on emitting and/or offering an incentive for emitting less. The price. What is Carbon Pricing? · Carbon pricing is an approach to reducing carbon emissions (also referred to as greenhouse gas, or GHG, emissions) that uses market. But most emissions are not yet subject to pricing. Where they are, prices are often too low. The World Bank has stated that the price should now be between $ oxygen and re-circulated CO2, which also contains water vapour. The economic feasibility of CCS on a global scale largely depends on the value and price that. EU Carbon Permits is expected to trade at EUR by the end of this quarter, according to Trading Economics global macro models and analysts expectations. The data on this page is no longer being updated. For the latest version of this graphic please go to Ember's European electricity prices and costs tool. It will be raised to S$45/tCO2e in and , with a view to reaching S$/tCO2e by This will strengthen the price signal and impetus for. In theory, a carbon price should be equal to the “social cost of carbon.” For example, if one ton of CO2 emissions costs the public $, it should cost $ to. A carbon price is a fee on each unit of carbon dioxide (CO2) or other greenhouse gas emissions released into the atmosphere. Through the Carbon Pricing Corridors Initiative, CDP is working with leaders from the business and investment communities to translate the uncertainty of future. This includes detailed information and visualizations on design attributes, GHG emissions coverage, price, and revenue. Click on the tabs underneath carbon. The federal and state governments set the CO2 price at 25 euros per tonne initially as of January Thereafter, the price is expected to rise, step by step. A multi-year study of the social cost of carbon, a critical input for climate policy analysis, finds that every additional ton of carbon dioxide emitted into. Stay informed with our Carbon Price Viewer for the EU Emissions Trading System (EU ETS). Discover the current carbon/CO2 price in Europe. A study estimated the social cost of carbon (SCC) to be over $ per tonne of CO 2—more than five times the United States Environmental Protection Agency. A study estimates a tax of $49 per metric ton of carbon dioxide could raise about $ trillion in net revenues over 10 years from to Carbon tax. A graph showing the emissions cap reduction starting at 71 million metric tons of CO2 in price that all bidders pay. Participants who bid below that. Carbon Allowance Prices; Auction Proceeds; Summary of Market Transfers by Year Current Auction Settlement Price is the price at which current vintage. Live Carbon Credits pricing and price charts. Today's carbon prices on the One EUA allows the holder to emit one ton of CO2 or C02 equivalent greenhouse gas. If this assumption is correct, then the incorporation of a risk pre- mium into carbon dioxide emissions prices has the paradoxical effect of reducing the.

Do I Have Money In My 401k

With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. You may be eligible to leave assets in the (k) plan if the vested balance (the amount you can take with you if you leave your job) is more than $7, What. With a traditional (k), employee contributions are deducted from gross income. This means the money comes from your paycheck before income taxes have been. Saving for retirement is a worthy endeavor and a financial task many people struggle with. Contributing the max to a (k) plan is not the best move if you. You can find your (k) balance by logging into your (k) plans online portal and check how your (k) is performing. Lower taxes: You get to invest money from your paycheck before taxes are taken out. · Automatic savings: Out of sight, out of mind. · Matching funds · A (k) can. are at least age 59 ½, or; qualify for another exception. Any unpaid loan amount also means you'll have less money saved for your retirement. Related. What type of account do you have? None (k) (b) (b). Current Balance The IRS sets limits on how much money someone can contribute to a (k). As much as you may need the money now, by taking a withdrawal or borrowing from your retirement account, you're interrupting the potential for the funds to grow. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. You may be eligible to leave assets in the (k) plan if the vested balance (the amount you can take with you if you leave your job) is more than $7, What. With a traditional (k), employee contributions are deducted from gross income. This means the money comes from your paycheck before income taxes have been. Saving for retirement is a worthy endeavor and a financial task many people struggle with. Contributing the max to a (k) plan is not the best move if you. You can find your (k) balance by logging into your (k) plans online portal and check how your (k) is performing. Lower taxes: You get to invest money from your paycheck before taxes are taken out. · Automatic savings: Out of sight, out of mind. · Matching funds · A (k) can. are at least age 59 ½, or; qualify for another exception. Any unpaid loan amount also means you'll have less money saved for your retirement. Related. What type of account do you have? None (k) (b) (b). Current Balance The IRS sets limits on how much money someone can contribute to a (k). As much as you may need the money now, by taking a withdrawal or borrowing from your retirement account, you're interrupting the potential for the funds to grow.

In some cases, if you've named your estate as the beneficiary, it will need to go through probate. Fidelity Smart Money. Feed your brain. Fund your future. In fact, most financial experts will suggest investing 15% of your income annually in a retirement account (including any employer contribution). With (k)s. The good news is that the Department of Labor (DOL) has established rules for protecting money put into a (k), so the money isn't necessarily lost—just. As much as you may need the money now, by taking a withdrawal or borrowing from your retirement account, you're interrupting the potential for the funds to grow. The good news is that the Department of Labor (DOL) has established rules for protecting money put into a (k), so the money isn't necessarily lost—just. With a traditional (k), employee contributions are deducted from gross income. This means the money comes from your paycheck before income taxes have been. But there's a catch: You'll have to pay taxes on your withdrawals when you take your money out in retirement. Basically, you're kicking your tax bill down the. A Rollover IRA is a retirement account that allows you to roll money from your former employer-sponsored retirement plan into an IRA. Changing jobs and wondering: "Should I roll over my (k) Also, you'll need to specify how the funds in your traditional IRA are to be invested. Yes you should contribute to it, especially if they provide a match, which is free money. When you leave that job you can roll that k into. Generally, if you take money from your account before you reach age 59 ½, you'll have to pay taxes on the amount, plus pay a 10% penalty to the IRS. But there. If you don't have any luck, Cavazos says that your best bet is to contact your former employer's HR or accounting department. By providing your full name. Employers can contribute to employees' accounts. Distributions, including earnings, are includible in taxable income at retirement (except for qualified. How Much Should I Have in My (k)?. If you're enrolled in a (k) plan, here is what you need to know about this retirement savings vehicle. no limit on funds that come from a (k) rollover. Even if you have a large amount of money in your (k), you can roll over all of it into a traditional IRA. The money will be invested for your retirement, usually in your choice of several mutual funds. With a few exceptions, you can't withdraw money without paying a. Learn more about how the NRURB can help. VIEW FAQ's. Search the NRURB for Your Unclaimed Retirement Funds. Find my funds. Powered by: La Mesa Blvd., Suite. The last factor that can have a materially negative impact on your (k) balance is high fees. Some (k) plans have large administrative and management. You can find your (k) balance by logging into your (k) plans online portal and check how your (k) is performing. If you don't have access to your. You will pay taxes on your traditional (k) funds as you withdraw them. You can withdraw without penalty at age 59½. But prior to that, you will pay a 10%.

Robinhood Algorithmic Trading

Welcome to Robinhood Crypto API documentation for traders and developers! The APIs let you view crypto market data, access your account information, and place. **Not available for trading in New York or Texas. Robinhood Crypto also supports real-time market data only for: 0x (ZRX); Algorand (ALGO); Apecoin (APE); Axie. Robinhood is a commission-free stock trading and investing app that allows people to quickly and easily begin investing in the stock market. Robinhood also provides traders with real-time market data and commission-free trading. TD Ameritrade: TD Ameritrade is a well-established brokerage firm that. Thus, it is best to host an algorithm either on AWS or Google Cloud in the North Virginia data centers. Robinhood server location. It is common knowledge that. proxies for Robinhood activities and institutional algorithmic trading. The replicated results are qualitatively similar to our main findings. We further. robin-stocks is a library that interacts with the Robinhood API and allows one to execute buy and sell orders, get real time ticker information. Recently Quantopian has integrated with Robinhood, a zero commission online broker for trading securities, however their app is only available. The name most likely refers to the legendary Robin Hood's “take from the rich, give to the poor” ethos, as RobinHood prides itself on commission-free trading. Welcome to Robinhood Crypto API documentation for traders and developers! The APIs let you view crypto market data, access your account information, and place. **Not available for trading in New York or Texas. Robinhood Crypto also supports real-time market data only for: 0x (ZRX); Algorand (ALGO); Apecoin (APE); Axie. Robinhood is a commission-free stock trading and investing app that allows people to quickly and easily begin investing in the stock market. Robinhood also provides traders with real-time market data and commission-free trading. TD Ameritrade: TD Ameritrade is a well-established brokerage firm that. Thus, it is best to host an algorithm either on AWS or Google Cloud in the North Virginia data centers. Robinhood server location. It is common knowledge that. proxies for Robinhood activities and institutional algorithmic trading. The replicated results are qualitatively similar to our main findings. We further. robin-stocks is a library that interacts with the Robinhood API and allows one to execute buy and sell orders, get real time ticker information. Recently Quantopian has integrated with Robinhood, a zero commission online broker for trading securities, however their app is only available. The name most likely refers to the legendary Robin Hood's “take from the rich, give to the poor” ethos, as RobinHood prides itself on commission-free trading.

Recognized for its commission-free trades and user-friendly app, Robinhood seeks to democratize finance and make investing accessible to all, not just the. Long Positions only (utilizing Robinhood) · Produce charting data that is similar to my view in Google Finance (1-month window, minute intervals) · Calculate. Robinhood, as advertised, charges $ commission on buys and sells. In their Fees Section they note that traders still have to pay the FINRA and SEC fees on. Fiverr freelancer will provide Trading Bots Development services and develop best automated stock trading bot for thinkorswim, etoro, robinhood within 4. Robinhood Trading Bots. Design and deploy your custom Robinhood trading bot. Take control of your trading with Robinhood trading bots that execute trades 24/7. Design a high-frequency trading bot for Robinhood. Implement strategies based on market analysis and execute rapid trades to capitalize on fluctuations in. Our Algorithmic Trading Robinhood In Powerpoint And Google Slides Cpb are topically designed to provide an attractive backdrop to any subject. Algorithmic trading involves using computer programs to make trading decisions based on predefined rules. With the Robinhood API, developers can build trading. Robinhood Crypto trading API is now live Developers and traders can now set up advanced and automated trading strategies, react to market. Robinhood data as an instrument for alteration of the algorithmic trading of institutional investors. Consistent with the conjectures, the termination is. I've been building automated algorithmic trading bots for a while now and I know Robinhood is the most common brokerage for us millennials but from my previous. Robinhood does not offer a trading API. TD Ameritrade still has an API. If you want an API for Robinhood you need to build your own. This library aims to create simple to use functions to interact with the Robinhood API. This is a pure python interface and it requires Python 3. Traders get liquid assets, supporting focused trading strategies. Robinhood features a broader asset selection consisting of equities, ETFs, IPOs, options, gold. ALGO, CSFB PATH, JEFFALGO). Robinhood: Robinhood provides free stock trading. Robinhood earns revenue by collecting interest on the cash and securities in. Using Python and Robinhood to Build a Long Call Trading Bot · What is a long call? A long call is a form of contract in options trading. · What we need. For those. Algorithmically trade stocks and options using Robinhood, Yahoo Finance, and more. api · stocks · trading · broker · finance · algorithm · market · options. Robinhood data scientists designed the algorithm that generates your recommendation and it's been carefully reviewed by investment professionals and third-party. Cryptocurrency trading offered through Robinhood Crypto, LLC. Securities offered through Robinhood Financial LLC, member FINRA/SIPC. Robinhood Crypto is. The Robinhood Bot is a trading algorithm that automates the buying and selling of stocks on the Robinhood platform. It uses real-time market data and preset.

How Much Can You Invest In 401k

Along with income limits for opening a Roth, the IRS also sets limits on how much you can contribute to your Roth IRA each year. Many employers also offer a. Employer-sponsored (k) plans may — but aren't required to — allow account holders to access savings through loans. Plans vary in their loan stipulations;. For that reason, many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). Of course, when you're just. You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed. Each employee participating in the plan determines how much money is to be automatically contributed from each paycheck. Generally, participants can invest. If you're 50 or older, you're eligible for a catch-up contribution. Catch-up contributions are a way for you to save more for retirement later in your life. You can invest a portion of your salary up to an annual limit.2; Your employer may or may not match part of your contribution. The money will be invested for. The annual k limit of $19, in , plus the additional $6, in catchup k (if you are age 50 by 12/31/19) does not include company. Most financial experts will suggest investing 15% of your income annually in a retirement account (including any employer contribution). Along with income limits for opening a Roth, the IRS also sets limits on how much you can contribute to your Roth IRA each year. Many employers also offer a. Employer-sponsored (k) plans may — but aren't required to — allow account holders to access savings through loans. Plans vary in their loan stipulations;. For that reason, many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). Of course, when you're just. You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed. Each employee participating in the plan determines how much money is to be automatically contributed from each paycheck. Generally, participants can invest. If you're 50 or older, you're eligible for a catch-up contribution. Catch-up contributions are a way for you to save more for retirement later in your life. You can invest a portion of your salary up to an annual limit.2; Your employer may or may not match part of your contribution. The money will be invested for. The annual k limit of $19, in , plus the additional $6, in catchup k (if you are age 50 by 12/31/19) does not include company. Most financial experts will suggest investing 15% of your income annually in a retirement account (including any employer contribution).

If, for example, your employer has a profit-sharing program that gives you significant (k) contributions, it could be possible for your personal yearly. Wondering How Much You Should Contribute to Your (k)?. Match with a invest your money—your employer takes care of all of that for you. That's. Then, as the employer, you can make a contribution of up to 25% of your compensation each year. Total contributions to a participant's account, including catch-. Many companies offer a (k) retirement plan to help you save and invest for the future. With a regular (k), your contributions come out of your paycheck. This limit increases to $76,5($73, for ; $67, for ; $64, for ; and $63,5if you include catch-up contributions. In. This is essentially free money you can use to grow your retirement savings, so try to contribute at least the amount your employer matches, if possible, to take. You can also choose how much of your paycheck to invest and how frequently you wish to contribute throughout the year. Your investments may grow over time. For workers under 50 years old, the combined limit for both employee and employer contributions is $69, per year. If the catch-up contribution for those It depends on your own unique retirement goals and other sources of savings. You might want to aim for your annual contribution from all sources — your own. For , the combined contributions you and your employer can make to the account is $69, ($76, if you're 50 and older and making catch-up contributions). $23, in ($22, in ; $20, in ; $19, in and ), or $30, in ($27, in ; $26, in and ) if age 50 or over;. According to the IRS, you can contribute up to $20, to your (k) for By comparison, the contribution limit for was $19, This number only. In traditional accounts (usually called traditional IRA or just k), you don't pay taxes on what you put in now, but pay taxes on later. The “8% growth”* column shows what you could potentially have in your (k) after so many years of a constant $20, per year contribution (ignoring catch-up. (k)s are the most popular retirement savings plan. More than 60 million Americans—or about 38% of the working population—use one to invest money they'll live. Annual contributions: Your total contribution for one year is based on your annual salary times the percent you contribute. However, your annual contribution is. How much can a small business owner contribute to a (k)?. The combined limit for employee and employer contributions to a (k) is the lesser of % of an. Wondering How Much You Should Contribute to Your (k)?. Match with a invest your money—your employer takes care of all of that for you. That's. Before maxing out your contributions, make sure you have money set aside in an emergency fund — three- to six-months' worth of living expenses is generally. Catch up. If you are 50 or older, be sure to make the most of catch-up contributions to your retirement savings plans. For , employees over

How To Cross Sell Products

In this article, we discuss 10 cross-selling tips sales professionals can use to exceed their quotas. Showing customers additional products or services that enhance the overall experience of their existing purchase. These additional services work hand in hand. Cross-selling is a sales technique that increases revenue by offering related products or services to prospects and customers. Cross-selling is when you persuade a customer to add complementary items to their cart—for example, convincing someone to buy a facial roller along with their. Example usage: Offer complementary products to a customer recently finished order on the website by recommending complementary products in a campaign. Example. Does your sales team have the motivation, product & customer knowledge, team collaboration and strong customer trust and loyalty to successfully cross-sell? Cross-selling is when a customer purchases a related product. It's one of the best ways to boost revenue and customer satisfaction. Here's how to do it. What kind of products to cross-sell · Related products: These are items related to the one that a customer is already purchasing. · Complementary products: These. Cross-selling is selling a different product or service to an existing customer. That is, you recommend products or services to your existing customers. In this article, we discuss 10 cross-selling tips sales professionals can use to exceed their quotas. Showing customers additional products or services that enhance the overall experience of their existing purchase. These additional services work hand in hand. Cross-selling is a sales technique that increases revenue by offering related products or services to prospects and customers. Cross-selling is when you persuade a customer to add complementary items to their cart—for example, convincing someone to buy a facial roller along with their. Example usage: Offer complementary products to a customer recently finished order on the website by recommending complementary products in a campaign. Example. Does your sales team have the motivation, product & customer knowledge, team collaboration and strong customer trust and loyalty to successfully cross-sell? Cross-selling is when a customer purchases a related product. It's one of the best ways to boost revenue and customer satisfaction. Here's how to do it. What kind of products to cross-sell · Related products: These are items related to the one that a customer is already purchasing. · Complementary products: These. Cross-selling is selling a different product or service to an existing customer. That is, you recommend products or services to your existing customers.

Definition: Upsellingis the practice of encouraging customers to purchase a comparable higher-end product than the one in question, while cross-selling. Upselling is a sales technique in which a salesperson entices customers to purchase more-expensive items or upgrades to make a more profitable sale. For example, someone shopping for swim trunks could also want sandals and sunglasses. To cross-sell products effectively, it's crucial to suggest items that. Upselling is the sales technique of encouraging a customer to purchase a premium option of the intended product. Unlike cross-selling, which encourages a. Grouping complementary items into an attractive package is one of the best ways to cross-sell customers to a higher-order value. Bundling is brilliant because. Cross-selling is promoting relevant products that complement what a shopper is about to buy. Or, in some cases, what they just purchased. Upselling is. Enable customers to purchase complementary products at checkout by using cross-sells. · The product must be associated with only a single Price. · The currency of. Cross-selling is a sales technique involving the selling of an additional product or service to an existing customer. In practice, businesses define. We discovered that one in five cross-buying customers is unprofitable. That group accounts for 70% of a firm's total “customer loss.”. Cross-selling is a strategy where customers are encouraged to buy related products or services along with their main purchase. To cross-sell is to sell related or complementary products to a customer. Cross-selling is one of the most effective methods of marketing. Cross-selling is a sales technique that involves promoting an item that is related to a product a customer has expressed interest in. When done successfully. The secret is finding just the right product incentive to pair with the primary product — and the right time (touchpoint) in the eCommerce buying journey to. Product bundling is one of the most effective ways of cross-selling eCommerce products. Here, you offer supplementary products that enhance the use of a primary. Upselling encourages existing customers to purchase a more expensive version of the same product, whereas cross-selling is about suggesting an additional item. Cross-sells help make more sales and help customers find products they may need but have yet to consider. What is Upselling? Upselling technique in Magento 2. Cross-selling opportunities are typically placed on the product page or during the checkout process in the form of related products and/or featured bundles. Create an upsell, cross-sell, frequently bought together, or related items recommendation box, place it on the product page, and change the style to. Cross selling is a sales technique, where a related product is suggested to the customer to add to their original purchase.

Retail Investor Trends

.png)

Retail ; Beer-making beyond planet Earth: How space-age technology could shape the industry · BUD % ; Super Micro offers investors a bit of relief after. “Investors now have a certain expectation of how seamless that experience needs to be, how quickly they can access a platform and in three clicks be able to go. 7 Growing Trends in Retail Investing · 1. Rise of ESG Investing · 2. Growth in Fractional Share Investing · 3. Focus on Cryptocurrency and Digital Assets · 4. This chapter examines the funds market and trends in Funds under Management (FUM) and net sales. The focus is on long-term trends for UK investors in both. A regulator noted that positive trends in terms of retail investment are being observed in several EU member states, particularly following the Covid crisis. retail investor access to private markets: Such proprietary market data is used by Blackstone to evaluate market trends as well as to underwrite potential and. Retail investors' engagement in the stock market has remained strong, marked by a shift towards more diversified asset classes and strategies. Diversification: Retail investors can diversify their portfolios by investing in various securities, such as stocks, bonds, and alternative investments. The growth of the retail investor over the last several years is undeniable. daily retail broker flows against weekly custodial settlement trends, we. Retail ; Beer-making beyond planet Earth: How space-age technology could shape the industry · BUD % ; Super Micro offers investors a bit of relief after. “Investors now have a certain expectation of how seamless that experience needs to be, how quickly they can access a platform and in three clicks be able to go. 7 Growing Trends in Retail Investing · 1. Rise of ESG Investing · 2. Growth in Fractional Share Investing · 3. Focus on Cryptocurrency and Digital Assets · 4. This chapter examines the funds market and trends in Funds under Management (FUM) and net sales. The focus is on long-term trends for UK investors in both. A regulator noted that positive trends in terms of retail investment are being observed in several EU member states, particularly following the Covid crisis. retail investor access to private markets: Such proprietary market data is used by Blackstone to evaluate market trends as well as to underwrite potential and. Retail investors' engagement in the stock market has remained strong, marked by a shift towards more diversified asset classes and strategies. Diversification: Retail investors can diversify their portfolios by investing in various securities, such as stocks, bonds, and alternative investments. The growth of the retail investor over the last several years is undeniable. daily retail broker flows against weekly custodial settlement trends, we.

Investors recognize the opportunities that exist with value-add real estate and continue to chase markets with strong tenant history. The daily average trading by institutional investors was 30% higher (A$ billion a day, compared with A$ billion over ). What retail investors are. Investor Study on the future of retail investment. Webinar: The Future of Retail Investing: Unpacking trends with the ASX 🗓️ Date. Also you see increasing investor demand. And retail investors are looking for private markets exposure. And at the same time, you have different fund structures. It's well-known that COVID triggered volatility in individual equities and the overall market as stock prices reflected fluctuations in corporate performance. Such price regulation could reinforce the trend to passive investment strategies while adding pressure on actively managed investments. Furthermore, it. Japan Retail Investors Embrace ESG Amid Pandemic, Nomura Survey Shows · Respondents placing importance on ESG investments climbed to about 40% in from 30% a. In this episode of the NextWave Private Equity podcast, Bridget Walsh discusses the entrance of retail investors in the private equity market with Jenny. Investment Trends delivers independent, deep insights research on the behaviours and needs of investors and intermediaries, to help financial services. Retail investor sentiment is beginning to rebound How confident are you in making investment decisions for your household? Client Confidence Trends. This article explores retail investors' performance, trends, and challenges throughout , shedding light on their achievements and areas for improvement. Private equity, however, still remains the most favored asset class within private markets, with 69 percent of institutional investors in APAC anticipating it. U.S. Retail Investor. Connect with U.S. Retail Investor Trends. Gauge the past performance of U.S. advisors and project future gains; Assess investor behavior. Lured by little-to-zero fees and the boredom they experienced while working from home (WFH) during the pandemic, retail investors have increasingly flocked to. Diversification: Retail investors can diversify their portfolios by investing in various securities, such as stocks, bonds, and alternative investments. The total volume of US dollar (DXY) Index trades on gulyasmir.site was up % since the start of the year. Retail traders' view of the dollar's future changed. Nasdaq conducted a survey of 2, retail investors — from Gen Z to Baby Boomers — to discover the latest trends in the investment decision-making process. Taking a quick step back, what's changing is that market share in retail is concentrating and consolidating among the largest players. And if you think about. Prior to Covid, there were several developments which set the table for this trend. And once Covid hit, a perfect storm of commercial models, technology, and. Where industry leaders come together to discuss emerging opportunities and industry trends shaping the global private equity landscape. Jenny Johnson. And.